Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Welcome! This section is intended to help you get up to speed on decentralized finance (DeFi) and navigate ApeBond's platform, including our Bonds, Utility token, Multi-chain DEX, and Earning opportunities.

If you have some crypto experience, but are new to DeFi, skip ahead to our DeFi Glossary.

📖DeFi GlossaryFor quick links to specific functions of the ApeBond platform, visit the Quick Start Guide.

⭐QuickStart Guide

ApeBond is a decentralized platform where users can buy tokens at a discount that vest over time, while projects build long-term liquidity and strengthen their treasury.

In other words: ApeBond is a Decentralized OTC Marketplace.

At the heart of ApeBond is the Bonds product. Bonds allow users to buy tokens from our partner projects at a discounted price. In return, users agree to a vesting period —usually between 14 to 60 days— during which the tokens are gradually unlocked. Users can claim as they earn, or wait until the full vesting period is over to redeem all tokens at once.

Users get access to discounted tokens from emerging and well-established projects.

Partners can raise funds and build long-term liquidity without the volatility of immediate token sales.

🛍 Buy Bonds: Acquire tokens at a discount compared to market price and explore exciting new Web3 projects. Enjoy early access, maximize gains, and join innovative ecosystems with offers available across 14 chains. 💰 Earn More: Lock our utility token ABOND to unlock Extra Discounts for Bonds and earn BNB in our Real Yield pool. 🔁 Swap Tokens: Use our multi-chain DEX aggregator to Swap tokens across different networks.

💸 Fundraising via Bonds: Sell tokens with a vesting schedule in exchange for stables or blue-chips. 💧 Liquidity Growth: Raise protocol-owned liquidity by bonding tokens in exchange for LP tokens. 🤝 Advisory and Co-Marketing: Work with our team to fine-tune strategy and expand your user base. 🌐 Ecosystem Network: Connect with other protocols, partners, and opportunities through ApeBond.

For more information, visit our Partners page.

Whether you're a DeFi newcomer or a crypto native, ApeBond provides accessible tools to participate in on-chain opportunities — securely, transparently, and across multiple chains.

New to ApeBond? Learn the basics with our I'm New Here section.

At ApeBond, we specialize in transforming traditional financial mechanisms into decentralized, community-powered solutions. Our pioneering approach to bonding allows projects at any stage to tap into crowd-sourced OTC markets, providing a unique on-chain platform for fundraising before or after TGE.

Leverage ApeBond’s expertise to access decentralized crowdsourced OTC sales, where users can purchase tokens at off-market rates, vested over time. This not only ensures gradual market integration but also protects token value and fosters sustainable growth.

Customized Bonding Strategies: Develop tailored bonding solutions that integrate seamlessly with your project's lifecycle and financial objectives, maximizing the potential of decentralized finance.

Enhanced Liquidity and Treasury Growth: Utilize our bonding mechanism to build additional DEX liquidity, grow your treasury, and generate recurring revenue.

Market Responsive Discounts: Discounts on token sales are dynamically adjusted based on market demand, ensuring fairness and high engagement.

Controlled Token Distribution: Tokens vest linearly over a designated period, promoting stability and reducing market shock.

Strategic Consultation: Engage with our team to outline your needs and explore how our decentralized bonding solutions can be tailored to your project’s specifics.

Program Design and Token Analysis: Collaborate to design a bond program that supports your token economy, from initial token provision to final user vesting.

Bond Launch and Management: Launch your custom bond program with full support from our marketing and technical teams to maximize reach and efficiency.

Continuous Optimization: Benefit from ongoing support and iterative improvements based on market feedback and performance analytics.

Partner with ApeBond and plug into a thriving network of innovators and market leaders in the decentralized finance space. By joining ApeBond, you gain more than just access to funding—you unlock a comprehensive ecosystem designed to propel your project to new heights.

Looking for a specific function on ApeBond? These tutorials will guide you from beginner to DeFi expert, giving you the confidence to navigate our protocol with ease. Click the applicable link below to learn more:

Liquidity Bonds offer users the opportunity to purchase tokens at a discount that vest over time, represented by an NFT, in exchange for Liquidity Provider (LP) tokens. The discounted tokens vest over a certain amount of time, becoming claimable to the holder of the Liquidity Bond NFT incrementally.

Each Bond's discount amount varies based on a combination of market forces. For more on how the discount amount is determined, visit the page.

To buy a Bond, a user must first create an LP token by adding liquidity to the DEX for the trading pair that corresponds to that type of Bond. For example, ABOND-BNB LP tokens are used to purchase the ABOND-BNB Liquidity Bonds, which yield ABOND tokens.

From there, users can visit the Bonds page on ApeBond, and select the Liquidity Bond they would like to purchase. Or, the user can instead use the feature to buy a Bond with a single token.

For more on how to purchase a Bond, visit our page.

The Real Yield mechanism is designed to directly reward ABOND holders by sharing the platform’s revenue. Users will be able to stake their $ABOND tokens into one of four new staking pools to earn $WBNB (Wrapped BNB), each offering varying lock durations, bonuses, and APRs:

45 days pool: 1x multiplier

90 days pool: 1.25x multiplier

180 days pool: 1.5x multiplier

365 days pool: 2x multiplier

These pools offer flexibility in terms of commitment, with longer lock periods providing higher rewards. Once the lock duration ends, users have the option to withdraw their tokens or continue staked to keep earning.

In addition to earning BNB, staking ABOND will now be the primary method to accumulate Ape Tier points, which unlock various benefits and rewards within the ApeBond ecosystem. Each staking pool comes with its own points multiplier, making it easy for users to climb the Ape Tier ranks by choosing a staking duration that suits their strategy.

For those who already hold veABOND positions, transitioning to the new staking pools is seamless. Existing veABOND holders can convert their positions by selecting the “Convert” option at the same page, and then choosing a pool with an equal or longer lock duration, ensuring a smooth process to stake and start earning rewards!

Users must connect a crypto wallet to the ApeBond website to access the platform’s features.

We use to connect users’ wallets to our site. Rainbow supports most major crypto wallets, including MetaMask, TrustWallet, Binance Web3 Wallet, Rabby Wallet, and more.

Visit the "" for instructions on using ApeBond's products with your wallet.

If you are a mobile user, please refer to "".

As of 12/12/2023

Migration (39.1%): Needed for the Migration. Matches the amount of BANANA locked one to one.

Ecosystem Fund (15%): A replacement for our current MasterApe, meant for allocating ABOND towards the growth of the protocol (e.g., Bonds).

Multiplier Buffer (14.9%): The amount needed to ensure everyone can migrate without being diluted.

Fundraise (10%): An allocation for fundraising.

Treasury (10%): For recurring marketing and operations expenses.

Team (5%): Allocated for the development of ApeBond. Has a 3-year linear vesting.

Bonus Bucket (5%): Additional rewards for those who choose to lock their BANANA for a longer period during the migration process.

Initial Liquidity (1%): Needed to provide Liquidity Pools for the newly migrated token.

If you own or work for a crypto project whose token liquidity is reflected in the Liquidity Health Dashboard, and you notice that it shows out of date information, you can use the Submit Data Update feature found at the top left of the LHD List View page or the bottom of your Project View page to submit a GitHub pull request with accurate, updated information.

If you own or have traded cryptocurrency before, but never used a decentralized exchange, staked in a pool, yield farmed, or tried any of the other services DeFi has to offer, this guide is for you. These are some of the most important concepts to understand to take advantage of the financial opportunities in DeFi.

DeFi Short for "decentralized finance", a catch-all term for financial services that are provided on public blockchains by leveraging smart contracts, including swapping tokens, adding liquidity, staking in pools, yield farming, and more.

Decentralized Exchange (DEX) A protocol that uses smart contracts to allow users to swap between crypto tokens without a centralized intermediary.

Automated Market Maker (AMM) An automated market maker is a type of DEX that uses a mathematical formula to price assets, rather than using an order book model of bids (buyers) and asks (sellers) typical in traditional finance on centralized exchanges.

Swap To trade some amount of one token for an equivalent amount of another token.

Liquidity The extent to which an asset is available to be bought or sold. In the context of a DEX, the amount of crypto tokens that can be traded for one another.

Liquidity Pool A combination of two crypto assets in a smart contract that allows a decentralized exchange to facilitate trading between the two tokens.

Liquidity Provider Someone who adds liquidity to a protocol by supplying (generally equal) amounts of two crypto tokens to a liquidity pool.

LP Token Short for "liquidity provider token," a new token that is created and granted to a liquidity provider as a "receipt" of the liquidity that they added to a liquidity pool.

Staking The act of depositing crypto tokens that you own into a protocol or smart contract to earn rewards.

Yield Farm A product that allows users to stake LP tokens to earn tokens as a reward. Yield Farms incentivize users to add liquidity to a DEX so that the DEX can continue to facilitate token swaps between the two tokens in the liquidity pool.

APR (Annual Percentage Rate) The rate of return on staked assets, exclusive of the effects of compounding. These are subject to change based on a number of different factors.

APY (Annual Percentage Yield) The rate of return on staked assets including the effects of compounding.

ARR (Annualized Rate of Return) The Annualized Rate of Return you would receive considering the current discount, adjusted for APR.

Bonds One of the main ApeBond products that allow users to access tokens at a discount in exchange for their liquidity provider (LP) tokens, or in exchange for single assets like blue chip tokens or stable coins. Each Bond is a unique NFT that represents the output tokens (ABOND or partner project tokens), which vest over a certain amount of time.

Zap A tool that simplifies complex transactions by automating the conversion and deposit of tokens into various protocols, streamlining the process and reducing both steps and transaction costs for users.

POL (Protocol Owned Liquidity) Protocol Owned Liquidity refers to the liquidity that a DeFi protocol owns themselves, which helps them enhance stability, sustainability, and risk management, differing from traditional liquidity farming where external providers temporarily contribute liquidity for short-term incentives.

Launchpad The Launchpad is one of the platforms in DeFi ecosystems that manage the initial offering of tokens for new projects, providing a secure environment for investors to engage with upcoming crypto initiatives.

Oversubscription The Oversubscription in DeFi token sales is when the amount of money offered by prospective investors exceeds the total value of tokens available, resulting in each participant receiving a proportion of the tokens relative to their contribution.

Bonds are dynamically priced directly proportional to demand, and inversely proportional to time. Accordingly, Bond pricing is determined by four primary factors:

The price of the input LP token, blue chip asset, or stablecoin that is used to purchase the Bond

The price of the output token (i.e., ABOND or a partner project token)

The time since the last Bond was purchased

Demand for a specific Bond

These factors combine to establish a discount on the output token, relative to the current market price on that output token.

Bonds start out at a specific discount, set by ApeBond. Over time, that discount will increase if the price of the input LP tokens (#1) and the price of the output token (#2) has no change in value, to make the Bonds more attractive to purchase.

When you purchase a Bond, the entire amount of the tokens you purchase will be discounted by the amount shown at the time of purchase.

If the price of the output token increases, and the price of the input token(s) decreases or stays the same, the discount of the Bond will increase, as you can now purchase the output at a larger discount (because the output token is worth more, and the input token(s) is worth the same or less). The two price points are diverging away from each other, increasing the discount.

If the price of the output token decreases and the price of the input token(s) increases or stays the same, the discount of the Bond will decrease, as you can now purchase the output token at a lower discount, as the output token is worth less and the input LPs are worth the same or more. The two price points are converging towards each other, decreasing the discount.

If the Bond discount indicator is a red, negative number, it means that purchasing the NFT will not return output tokens at a price lower than the current market rate. Users can still purchase Bonds and receive output tokens and their NFT, but must acknowledge that they are purchasing at a price higher than the current market value.

Follow the steps below to purchase a Reserve Bond: 1) Connect your wallet to ApeBond (for instructions, visit the How to Connect Your Wallet page).

2) Hover over Bonds in the nav bar, and then click "Buy a Bond" to visit the Bonds page.

3) Locate the Reserve Bond you'd like to purchase and click the row.

If this is your first time purchasing the Reserve Bond, you will have to enable the Bond’s contract first.

4) Enter the amount of input tokens you’d like to use to purchase the Bond. The amount of output tokens (partner tokens) that the Reserve Bond is worth will automatically update based on the amount of tokens you enter.

5) Click Buy.

Done! You now own a Bond. The applicable NFT will show up in your wallet, and output tokens will begin vesting over the amount of time shown on the Bond.

Once you own a Bond, you'll see Claim and View buttons on the Bonds page. You can claim any vested tokens from an individual Bond using the Claim button, or you can use the Claim All button at the top right to claim all vested tokens across multiple Bonds.

To connect your wallet to ApeBond, please follow the steps below:

1) Click our homepage link or enter the URL (https://ape.bond) into your browser.

NOTE: Make sure to verify the web address above, and avoid using search engines to find our site. Some search results present fake ApeBond phishing sites which could compromise your wallet.

At no point will you be asked for your private key/seed phrase on the official ApeBond site. If you are asked for these details, DO NOT ENTER THEM - you are not on the real ApeBond site!

2) Click on the Connect button in the top right-hand corner of the page.

3) The wallet popup shows a list of supported wallets. Choose the applicable wallet. If this is your first time connecting your wallet, you may be asked to give permission for the site to connect. In this example, we'll use MetaMask to connect.

4) If you have multiple wallets within the same account, select the appropriate wallet address.

5) Once the correct wallet has been selected, continue by clicking Confirm on the wallet popup.

6) Once connected, the homepage will show part of the public address in the top right-hand corner of the screen.

Your selected wallet is now connected to the ApeBond site. You can now buy Bonds, swap tokens, add liquidity and more!

Continue to our Bonds page to learn how to buy bonds on the ApeBond.

Follow the steps below to stake ABOND to earn wBNB and the ape tiers through the Tier Staking page:

1) Connect your wallet to ApeBond (for instructions, visit the How to Connect Your Wallet page).

2) Click Tier Staking on the nav bar.

3) Input the amount of ABOND you wish to lock for veABOND.

4) Input the amount of ABOND you wish to stake to earn wBNB.

5) Check the details to ensure the values are accurate, and click “STAKE ABOND”.

6) Done! You can now start earning wBNB and unlocking exclusive benefits and utilities based on your Ape Tier!

7) Scroll up to check your Ape Tier. Improve your Ape Tier to unlock more utilities!

Reserve Bonds offer users the opportunity to purchase tokens at a discount that vest over time, represented by an NFT, in exchange for a single underlying asset. The discounted tokens vest over a certain amount of time, becoming claimable to the holder of the Reserve Bond NFT incrementally.

Each Bond's discount amount varies based on a combination of market forces. For more on how the discount amount is determined, visit the Bond Pricing page.

Bonds PricingTo buy a Bond, a user must acquire the single token required to purchase the Bond. For example, USDT tokens are used to purchase the ABOND Reserve Bonds, which yield ABOND tokens.

From there, users can visit the Bonds page on ApeBond, and select the Reserve Bond they would like to purchase.

For more on how to purchase a Bond, visit our How To Buy A Bond page.

⭐How To Buy A Reserve BondThe ApeBond website is viewable on mobile devices, but to use ApeBond's products and features from mobile devices, you will need to connect to the platform from a mobile-enabled crypto wallet.

NOTE: You cannot connect directly to ApeBond to buy bonds, swap tokens, or perform any other actions on the platform if you're using a mobile browser (like Safari or Chrome), and not the browser from within a mobile crypto wallet app.

Make sure you're using your preferred crypto wallet's mobile app to connect to ApeBond!

Follow the instructions below to connect to ApeBond from a mobile device:

1) Open your crypto wallet mobile app on your mobile device (in this example, we'll use the MetaMask app for iOS).

2) Select the Browser option.

3) Select the Search option

4) Navigate the wallet app browser to ape.bond.

5) Click Connect.

6) Select your preferred wallet.

7) Once connected, the homepage will show the gear icon in the top right-hand corner of the screen.

After connecting your wallet through your mobile crypto wallet app's browser, you can utilize ApeBond's features just as you would in a desktop browser.

Each of the three components has a weighted coefficient (x, y, and z) to factor in the importance of each feature in the overall score. Currently:

Liquidity Strength (LS) = 50% of score

Liquidity Ownership (LO) = 35% of score

Liquidity Concentration (LC) = 15% of score

These three category scores are then weighted through ApeBond’s custom-built formula above to generate an aggregate Liquidity Health Score on a scale of 0-100. The Liquidity Health Score is the primary metric that will be shown when sharing information from the Liquidity Health Dashboard.

The Sustainability Range defines what ApeBond believes is an appropriate amount of liquidity for any given MCAP. This is a range, with an upper and lower bound, we believe if you are inside the range you are in a healthy spot.

This is the backbone of the liquidity health dashboard and the LS and LO scores are derived off this range.

ApeBond gathered liquidity data on over 1500 active projects on EVM compatible chains and plotted them on a chart, looking at extractable liquidity and market capitalization.

Through various exploratory analyses on the industry's data, ApeBond created a deep understanding of what tendencies to look for. Using those tendencies, ApeBond modeled a custom function to describe the average behavior and optimized its parameters to fit the industry's current situation.

ApeBond then analyzed that data based on the experience of running a DEX for over two years, knowledge of how consistently crypto projects fail, and working closely with liquidity. It discovered that the industry average is very low, the entire industry does not put enough emphasis on liquidity.

ApeBond then optimized the equation parameters to define the lower bound of the "sustainability range". This included breaking the parameters up for projects below $250M and above, resulting in two formulas that integrated a number of important insights:

The industry is clearly undercapitalized - this is a primary driver why so many token charts are down and to the right.

When a project prints tokens, it must back those tokens with capital. Projects tend to launch tokens, put millions of dollars worth of the token into circulation, then put less than $250k backing the token. That degree of leverage is typically impossible to sustain.

Newer projects need more liquidity backing their token. With a smaller MCAP, there is more risk, as the project is less established, and needs a better trading environment to start.

All tokens need liquidity backing the token. If a project has no liquidity backing the token, then the token is worthless. If one cannot sell it for a hard asset, it is effectively worthless.

ApeBond then further pressure tested this model with slippage and price impact analysis on how much liquidity a project needs to be able to facilitate reasonable trade sizes with a slippage tolerance of roughly 5% and a price impact tolerance of 10%. This validated the model even further.

ApeBond used the industry average as the backbone of the sustainability range, defining an industry formula with tunable parameters. It then used the constant product formula, slippage and trade size analysis, and logical arguments from working with over 250 projects to dial in a final sustainability range.

A New Sandbox for Web3 Builders and Explorers

Testnet Bonds are designed to mirror our mainnet bonding experience while operating entirely within testnet environments. This means users can participate in a simulated, risk-free version of our bonding protocol — perfect for experimentation, education, and community engagement.

Bonds are deployed using public testnet infrastructure

Users interact with the ApeBond interface just like they would on any supported chain

Instead of real tokens, all transactions use testnet tokens (which have no real-world value)

All actions — bonding, vesting, claiming — follow the same smart contract logic as on mainnet

This setup gives builders and users the ability to explore bonding mechanics, test UIs, and run campaigns in a low-stakes environment.

But Testnet Bonds are more than just a simulation — they’re a sandbox for innovation.

For builders, it’s a no-risk playground to test token distribution strategies, gather community input, and validate key product decisions.

For users, it’s a way to explore new ecosystems, learn by doing, and potentially earn future rewards — all while being early.

Since Testnet Bonds don’t involve real assets, we utilize “fake” tokens that mimic the behavior of real project tokens. These are deployed specifically for testnet campaigns.

Here’s how we structure it:

Each project receives a supply of testnet tokens (e.g., tETH, tBTC, etc.)

Participants use testnet assets (e.g., tMON) to “purchase” Bonds

Vesting and claiming simulate real-time accruals, allowing users to redeem fake tokens over the vesting period

This structure enables projects to test token distribution mechanics and community response before going live — a vital step in ensuring product-market fit on mainnet.

The tokens are fake, but the rewards (when distributed) are real.

To incentivize early adopters and testers, some Testnet Bond campaigns may offer future benefits such as:

Mainnet airdrops

NFTs or collectibles

Whitelist spots for token launches

Reward eligibility is usually tied to:

Volume and frequency of testnet Bond purchases

Completion of campaign quests (e.g., via Galxe or Zealy)

Community contributions like feedback, tutorials, threads, or memes

So, even though the tokens are simulated, your activity might just pay off in the long run.

Explore Testnet Bonds now at the bottom of our page, and start your journey into the next generation of decentralized finance — without the risk.

Let’s build the future together. 🚀

ApeBond’s mission is to provide sustainable financial opportunities for both crypto users and projects in a transparent, accesible, and secure way.

We aim to decentralize traditional finance and help build a fair global economy through a sustainable, community-driven DAO.

Accessibility: We create tools for users to leverage DeFi opportunities, regardless of background, wealth, or experience.

Transparency: We build together through community-driven governance and transparent processes that ensure our users are aligned with our collective goals.

Security: Our highest priority is to maximize the safety of our users' funds, our partner projects, and our community. Check out the section of this documentation for more information.

Sustainability: We aim to revolutionize DeFi with a sustainable approach, instead of predatory practices which only look for short-term benefits.

Every member of ApeBond’s dedicated and experienced team is committed to furthering our mission and vision for the future of finance.

If you’re interested in learning more about ways that you can contribute to ApeBond, please visit our .

Zap provides a rapid solution for users with single tokens on BNB Chain or Polygon to engage with ApeBond's DeFi offerings. This feature simplifies the process by reducing the number of steps required.

There are two main methods to utilize the Zap on ApeBond.

It allows users to go from a single token to a liquidity provider (LP) token in a single transaction. Before Zap, users had to manually acquire both tokens of an LP pair, then combine them to receive a LP token that represented that LP pair.

Users can use a toggle on the Get LP modal to enable Zap. The Zap option will allow users to select an asset in their wallet (e.g., BUSD) and receive the target LP pair (e.g., ABOND-BNB) in one transaction.

This feature enables users to directly purchase bonds using a single token, simplifying the process significantly. Previously, users had to first form a Liquidity Pair (LP), either manually or via a single-token-to-LP Zap, and then use these LPs to buy bonds. By simplifying this process, it minimizes the number of transactions required for users to begin acquiring vesting tokens at a discount through Bonds.

This feature enables users to purchase Reserve Bonds directly with a wide range of blue-chip cryptocurrencies or stablecoins. Users no longer need to hold a specific token to buy Reserve Bonds—they can simply use their preferred asset. This streamlined approach makes it easier to acquire discounted, vesting tokens with enhanced flexibility and convenience.

Follow the steps below to complete a trade on the ApeBond:

1) Connect your wallet to ApeBond (for instructions, visit the How to Connect Your Wallet page).

2) Click Swap in the nav bar

3) Select the tokens you wish to trade by clicking on the token icons and selecting from the dropdown list.

If you are attempting to trade a token for the first time, you will need to approve the token contract within your wallet using the Enable button before trading.

4) Select both the desired Chain and token.

For this example, we're selecting Polygon as the Chain and $QUICK as the token.

5) Input the amount you wish to trade or receive. The platform will automatically calculate and display the corresponding amount for the other token.

6) Expand the details section by clicking the triangle icon to view more information.

7) Check the details to ensure the values are accurate

8) Initiate the trade by clicking on “Bridge”.

Note: If you're swapping tokens on the same chain, this button will say "Swap" instead.

9) Confirm the transaction in your wallet.

Once a trade is completed, you can click "View on explorer" to see your transaction details. If successful, the swap should be reflected in your wallet's token balances shortly after.

Ticker: $ABOND

ABOND is the primary native utility token of the ApeBond ecosystem. ABOND ties holders with the protocol like never before.

Token Contracts

BNB Chain (BEP-20)

Polygon

Ethereum

To unlock special utilities of ABOND, users need to gain Tier Points by locking/staking ABOND in different pools, each with different locking durations. The Tier Points system assigns users an Ape Tier based on their accumulated points.

Discount Boost: With locking ABOND you can access greater discounts on Bonds, enabling you to get tokens at an even lower cost based on your tier. More higher tier equals a higher additional discount.

Special Bonds: Exclusive access to Tier Gated Flash Sales is granted by holding more tier points to attain higher tiers.

Real Yield: Ecosystem Bonds and the liquidity generated from them distribute all their revenue as Real Yield directly to tier points holders.

Governance (Upcoming): Holders will decide on ABOND's emissions through on-chain Governance, directing the Ecosystem Fund emissions towards the Ecosystem Bonds of their choice via votes and bribes. Traditional off-chain Governance will also available to ABOND holders. In both cases, holding more ABOND results in more voting power.

The Tier Points system ties the ability to gain access to special utilities to the staking/locking of ABOND, which grants points for Ape Tiers. The higher the tier, the more benefits you'll have. This model encourages long-term investment and greater accumulation of ABOND, fortifying our token’s value and the overall strength of our protocol.

Each tier offers escalating privileges, incentivizing users to stake/lock in more tier points, leading to enhanced access and benefits.

Users can purchase ABOND tokens on the Swap page using the BNB chain, Polygon and Ethereum.

Visit the How To Get ABOND page to learn more.

⭐How To Get ABONDWe recommend Stargate finance to bridge ABOND token across different blockchains.

Follow the steps below to buy ABOND thorough Swap page:

1) Connect your wallet to ApeBond (for instructions, visit the How to Connect Your Wallet page).

2) Click Swap on the nav bar.

3) Select the token and enter the amount you'd like to trade for ABOND. If you are attempting to trade a token for the first time, you will need to approve the token contract within your wallet using the Enable button before trading. The other amount will be automatically pre-filled.

4) Check the details to ensure the values are accurate, and click “Swap”.

5) Click Migration on the nav bar.

6) Enter the amount and select the Vesting Term. If you are attempting to migrate for the first time, you will need to approve the Migration bond contract within your wallet using the"Approve Contract" button before migrating.

7) Check the details to ensure the values are accurate, and click “MIGRATE!”.

Done! You now own a Migration Bond. The applicable NFT will show up under the "Your Migration Bonds" section below, and output tokens will begin vesting over the amount of time shown on the Bond.

Once you own a Migration Bond, you'll see Claim and View buttons on each Bond. You can claim any vested tokens from an individual Migration Bond using the Claim button.

ApeBond has built a strong community of hundreds of thousands of users from across the world, and our core team is dedicated to caring for and providing support to each and every community member. We constantly keep our community up to date on the latest ApeBond news and announcements, and we encourage positive, engaging conversation across all of our social channels.

🐦 Twitter - https://twitter.com/ApeBond

📰 Medium - https://apebond.medium.com/

🤳 Instagram - https://www.instagram.com/ape.bond/

🎨 Brand Kit - https://apebond.click/brandkit

🖥 GitHub - https://github.com/ApeSwapFinance

👾 Discord - https://apebond.click/discord

👽 Reddit - https://reddit.com/r/ApeBond

💬 Telegram

Main Group: https://t.me/ape_bond

Announcements: https://t.me/ApeBond_News

Price Discussion: https://t.me/ApeBond_Price

ApeSwap NFT: https://t.me/apeswapnft

💬 Telegram by Language

🇺🇸 🇬🇧 🇦🇺 English - https://t.me/ape_bond

🇪🇸 🇲🇽 🇦🇷 🇨🇴 Spanish - https://t.me/ApeBond_Espanol

🇹🇷 Turkish - https://t.me/ApeBond_Turkish

🇷🇺 Russian - https://t.me/ApeBond_Russia

Follow the steps below to purchase a Liquidity Bond:

1) Connect your wallet to ApeBond (for instructions, visit the How to Connect Your Wallet page).

2) Hover over Bonds in the nav bar, and then click "Buy a Bond" to visit the Bonds page.

3) Locate the Liquidity Bond you'd like to purchase.

4) Choose the token that you want to use to purchase the Bond.

You can purchase Liquidity Bonds with single assets via Zap, or with Liquidity Provider (LP) tokens. If this is your first time purchasing the Liquidity Bond, you will have to enable the Bond’s contract first.

5) Enter the amount of input tokens you'd like to use to purchase the Bond. The amount of output tokens (Partner tokens) that the Bond is worth will automatically update based on the amount of tokens you enter. Then, click BUY.

Done! You now own a Bond. The applicable NFT will show up in your wallet, and output tokens will begin vesting over the amount of time shown on the Bond.

Once you own a Bond, you'll see Claim and View buttons on the Bonds page. You can claim any vested tokens from an individual Bond using the Claim button, or you can use the Claim All button at the top right to claim all vested tokens across multiple Bonds.

Follow the steps below to stake ABOND to earn wBNB and the ape tiers through the Tier Staking page:

1) Connect your wallet to ApeBond (for instructions, visit the How to Connect Your Wallet page).

2) Click Tier Staking on the nav bar.

3) Choose the veABOND position you wish to stake and start earning wBNB.

4) Choose the staking pool you wish to stake to earn wBNB.

5) Check the details to ensure the values are accurate, and click “STAKE”.

6) Done! You can now start earning wBNB and unlocking exclusive benefits and utilities based on your Ape Tier!

7) Scroll up to check your Ape Tier. Improve your Ape Tier to unlock more utilities!

Quick answers to the most frequently asked questions about ApeBond.

Bonds

Tiers & Bonuses

Support & Safety

Transferable Vesting NFTs brought to you by ApeBond & Paladin

ApeBond and , a blockchain security provider, collaborated to develop an extension to the ERC-721 standard that allows for exciting new functionality for NFTs. The standard is the result of careful consideration of what NFTs can and should be, as well as many rounds of real-world testing and iteration.

ApeBond has revolutionized its decentralized exchange (DEX) into a cross-chain DEX aggregator through its partnership with Li.Fi (LiFi link). This new feature makes it easier for users to trade tokens across different blockchain networks. Now, users can move assets from one chain to another and swap tokens in one simple step. Before, they had to do several steps for bridging and swapping. This change makes using multiple blockchain networks more straightforward and faster.

A user has USDC on Polygon and wants to purchase ABOND on the BNB chain, they can easily use our Multi-chain DEX to transfer their USDC and convert it to ABOND in a single click on Polygon. This not only saves time but also eliminates the common hurdle of acquiring native gas tokens on the receiving chain. Additionally, users can continue to conduct token swaps exclusively within the same blockchain if they choose.

To effectively navigate and use a DEX aggregation service, it's essential to familiarize yourself with some fundamental concepts:

Visit our How to Swap guide for token exchanges.

Check out our for tutorials on how to use the ApeSwap platform.

If you're experiencing issues when using ApeBond's features, try these steps first:

Refresh the page

Clear your browser's cache

Restart your device

Try another RPC (for more info, review )

User Support for ApeBond is available through our fantastic community admins!

If you’re experiencing issues, we recommend reaching out to our team in the channel of our Discord server.

If you choose to reach out via Telegram, be aware that our admins will NEVER contact you asking for personal information or funds.

Our team members and admins will NEVER DM you first!

Never, under any circumstances, give someone your private key/seed phrase/recovery key!

BANANA

60 days

BANANA

120 days

BANANA

180 days

BANANA

360 days

GNANA

60 days

GNANA

120 days

GNANA

180 days

GNANA

360 days

Liquidity Ownership (LO) measures the ratio between the amount of token liquidity that a project owns compared to the amount of liquidity a project should own. This metric is designed to look at a project’s “liquidity debt”: the difference between a project’s owned, extractable liquidity and a baseline level of sustainable liquidity.

Simply put, LO looks to answer the following question: Does this project own ample liquidity to back the token based on its MCAP?

for

for

where:

for

for

where:

Constants configs.:

For M. Caps. <= $250M:

For M. Caps. > $250M:

Variables description:

: Market cap. in usd

: Extractable liquidity to market cap. ratio

: Owned valid extractable liquidity in usd

: The ratio considered the minimum health standard for any given market cap.

We directly compare owned extractable liquidity vs the sustainability range lower bound.

The difference between this and LS is what sustainability range bound we compare to (upper for LS vs lower for LO) & whether or not rented liquidity is factored in (rented + owned for LS vs owned for LO).

The more owned liquidity you have, the better score you receive. If you have no Protocol Owned Liquidity you would receive a 0 score. If owned liquidity is equal to or greater than the sustainability range lower bound, then you score a perfect 100. That would signify the project owns the minimum amount of liquidity that we have determined is sustainable. Anything in between scores from 0 to 100.

One thing to note - projects get rewarded with more points towards their score early on. Think of it as a simple sqrt(x) graph, where your score goes up faster at the beginning and slower towards the end. For example, right now if a project owns 25% of the liquidity we deem they should, we are giving them a score of 50/100. This is purposeful to drive the importance of POL.

Liquidity Concentration (LC) measures the degree to which the liquidity for a project’s token is concentrated to a certain number of liquidity pools. This metric is simple - the fewer pools you have scattered across the blockchain, the more concentrated your liquidity is and the more accessible that liquidity will be with lower slippage and price impact when trading.

Simply put, LC looks to answer the following question: Is this project’s liquidity too spread out?

where:

Constants configs.:

Variables description:

: The order each 'penalizable pool' gets assigned by applying the criteria defined below

: Tag that stands for 'untracked'

: Extractable Liquidity in pool

: Extractable liquidity in pools with tag

: Total extractable liquidity of the project

: Total number of pools in the list

We look at the overall concentration of pools, and see if the project is spreading their capital too thin.

If any pool has more than $250k of Extractable liquidity then it is automatically not penalized. That is driven by the fact that a pool of that size is material enough to actually benefit your token and provide a decent trading experience for users.

Additionally the first pool below $250k of EL is also not penalized. Depending on a project's goals, it is reasonable to be working on building up an additional liquidity pool.

If there are invalid pairs they are thrown out as that liquidity is likely useless.

The weight of the penalty depends on the number of additional liquidity pools you have below $250k EL and their proportional weight to the overall extractable liquidity the project has.

To put simply, if you have one liquidity pool you automatically get a score of 100. If you have multiple pools all above $250k you also get a score of 100, or if you have a single pool after those multiple pools that is below $250k.

When you start to have multiple pools below $250k you begin to get penalized based on how large those pools are compared to the sum total liquidity you have.

Only valid pair pools are considered, and must be ordered by decreasing extractable liquidity value.

Lastly, assign each pool in the ordered list an value or a tag ( standing for ‘untracked’), starting with 1 for the first of the kind, and increasing by 1 for each subsequent pool of the same kind. Pools with extractable liquidity greater or equal than $250,000 should be assigned a tag, and should not be assigned an value, nor should these pools have any effect on the value assigned to the rest of the pools in the list.

Example 1: Project with no tag pools

LC calculation:

Pool 1 -> $100,000 extr. liq. BANANA-WMATIC (‘valid pair’) ->

Pool 2 -> $85,000 extr. liq. BANANA-USDC (‘valid pair’) ->

Pool 3 -> $23.000 extr. liq. BANANA-BUSD (‘valid pair’) ->

Then:

Example 2: Project with tag pools

LC calculation:

Pool 1 -> $300,000 extr. liq. BANANA-WBNB (‘valid pair’) -> tag

Pool 2 -> 250,000 extr. liq. BANANA-BUSD (‘valid pair’) -> tag

Pool 3 -> $100,000 extr. liq. BANANA-WMATIC (‘valid pair’) ->

Pool 4 -> $85,000 extr. liq. BANANA-USDC (‘valid pair’) ->

Pool 5 -> $23.000 extr. liq. BANANA-WBTC (‘valid pair’) ->

Then:

ERC 5725: Transferable Vesting NFTs is an EIP created to offer a standardized Non-Fungible Token (NFT) API to enable vesting ERC-20 tokens over a vesting release curve. Read on to learn more about how to implement EIP-5725 for your own use cases

After reading through ERC-5725, the main section you will focus on during integration will be the ERC-5725 specification.

The key words “MUST”, “MUST NOT”, “REQUIRED”, “SHALL”, “SHALL NOT”, “SHOULD”, “SHOULD NOT”, “RECOMMENDED”, “MAY”, and “OPTIONAL” in this document are to be interpreted as described in RFC 2119.

During the integration process, take some time to read carefully through the natspec comments of the ERC-5725 specification to ensure you are implementing the functions the correct way. The key words above help define how the functions should work, given different inputs.

A usable IERC5725.sol is stored publicly on the GitHub ERC-5725 reference implementation. This can be used as the base for ERC-5725 NFTs.

Follow along below for how to use this interface to create your own ERC-5725 NFTs.

Bonds were created as part of ApeBond's initiative to ensure the long-term health of both our partners and ourselves by offering new ways to raise funds and generate sustainable liquidity, while providing users with opportunities to acquire tokens at a discount.

Inspired by a combination of TradFi, DeFi, and NFT products, Bonds allow users to access tokens at a discount in exchange for their liquidity provider (LP) tokens, or in exchange for single assets like blue chip tokens or stable coins. Each Bond is a unique NFT that represents the output tokens (ABOND or partner project tokens), which vest over a certain amount of time.

Bonds leverage the technology from ERC-5725: Transferable Vesting NFT, an officially approved Ethereum Improvement Proposal co-authored by the ApeBond team. Learn More in the link below.

ERC-5725: Transferable Vesting NFTTypes of Bonds

Reserve Bonds allow projects to diversify their treasuries by selling NFTs that represent their native token at a discount that vests over time, in exchange for a single asset such as a blue chip token or stablecoin.

Liquidity Bonds allow users to sell their LP tokens to receive an NFT that represents ABOND tokens or partner project tokens at a discount, vesting over a certain period of time.

Bonds are designed to offer the best way for partner projects to raise funds using their native tokens, addressing several challenges in the DeFi space. Partner projects benefit as their users also have the opportunity to acquire tokens at a discount.

Leveraging historical data, ApeBond AI provides personalized recommendations, continuously optimized by Bonds' performance.

Optimized Bond Configurations: Determine the most effective Bond amounts, vesting periods, and durations, with AI-driven insights. ApeBond AI ensures that your Bond conditions are aligned with current market dynamics, maximizing appeal to investors.

Dynamic Adaptation: Stay ahead in a rapidly changing market. ApeBond AI continuously adapts its recommendations based on real-time data, ensuring that your Bond conditions remain optimal amidst evolving market scenarios.

When a user purchases a Bond, they receive an NFT that represents the discounted tokens as they vest over time. The holder of the NFT is the only one who can claim tokens as they vest. Each Bond NFT consists of a combination of five procedurally-generated characteristics:

The Certification: The frame color around the legend reflects the purchase amount, ranging from bronze to diamond for the highest-value NFTs.

The Legend: The trailblazers of cryptocurrency, including Bitcoin founder Satoshi Nakamoto, Ethereum co-founder Vitalik Buterin, and Lighting Labs CEO and founder Elizabeth Stark.

The Location: Digital and physical spaces which created early use cases for cryptocurrency, such as The Silk Road, The Sandbox, and Switzerland’s Crypto Valley.

The Moment: Key developments which helped to shape where the cryptocurrency atmosphere is today, including the Bitcoin hard fork, the moment when Tesla began accepting Bitcoin for purchases, and Bitcoin becoming legal tender in El Salvador.

The Trend: Trends which developed further utility and use cases for cryptocurrency, including the HODL phenomenon, GameFi, and (naturally) NFTs.

The Innovation: Innovations that revolutionized DeFi, blockchain, or the internet as a whole, including Smart Contracts, Proof-of-Stake, memes, and more.

Bonds sold on ApeBond will gradually require users to hold a minimum Ape Tier. To achieve a Tier, users will need to stake ABOND in our Tier Staking page.

This system removes ABOND from circulation and locks it in staking pools.

Higher tiers unlock better Bonds, premium access, and exclusive opportunities.

It’s a natural way to connect bond buyers with the ABOND token!

We will continue to expand our platform and introduce new campaigns where users must hold a Tier to participate. This approach will further enhance ABOND’s value and demand.

New blockchains, even beyond EVM (wink), will require higher Ape Tiers for early access.

ABOND holders will always have access to exclusive events, airdrops, and special campaigns.

A Revenue Share from all Bonds in our platform will be distributed to ABOND holders via Real Yield. The fees collected will directly benefit the ecosystem by aligning incentives with all ABOND holders.

Sustained Revenue Share will increase price stability and reduce supply pressure.

Users will have aligned incentives with the platform — more Bond volume will result in more yield for every ABOND holder!

Our Extra Discount utility is very close to being finished and will soon reward our holders with additional discounts on every Bond they acquire.

Better Tier equals higher discounts!

This directly benefits our most committed community members.

ApeBond aims to become a thought leader in standardizing best practices for liquidity health, tokenomics, and treasury diversification, while breaking down the complexities for easy public consumption and creating the first ever industry-wide credentialing system. The tools that ApeBond has worked to create have been built around three core values: objectivity, uniformity, and ease of use; starting with a laser focus on liquidity as a key concept for users and projects to understand, and expanding from there.

In pursuit of those values, ApeBond has created new opportunities for users and projects to evaluate crypto assets for themselves through the Liquidity Health Dashboard.

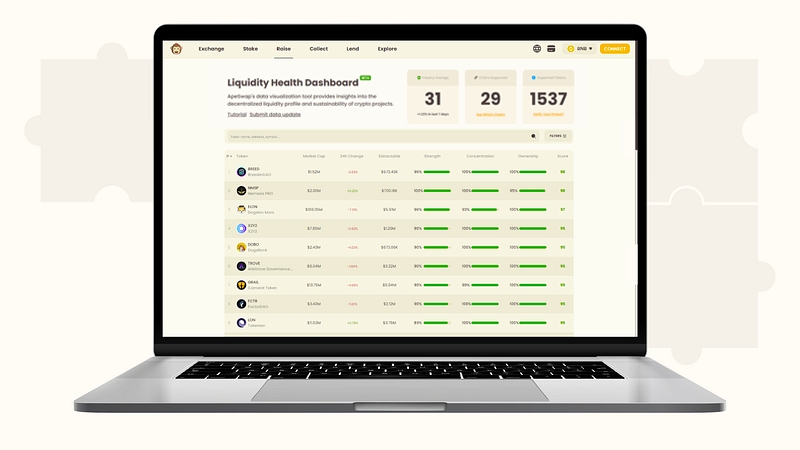

The Liquidity Health Dashboard (or "LHD") synthesizes liquidity data from over 1500 crypto projects around the world to provide a metric by which users can assess the status of a project's liquidity: their Liquidity Health Score. The Liquidity Health Score is designed to be consistent (in that it can be used to compare projects of all shapes and sizes), objective (in that it is not inherently biased towards or away from any particular characteristics of a crypto project), and accurate (in that the data used to create it is pulled directly from the blockchain or reputable, up-to-date sources).

The formula that dictates the Liquidity Health Score consists of three primary factors: Liquidity Strength, Liquidity Ownership, and Liquidity Concentration. Each score is measured on a scale of 0-100, with 0 representing the weakest score and 100 representing the strongest.

Finally, we take a weighted average of the three individual scores to provide an overall score for the token: their Liquidity Health Score.

For a detailed breakdown of how the Liquidity Health Score is calculated, visit the Methodology page:

For a comprehensive list of the terms used in relation to the LHD, visit the LHD Glossary & Tags page:

If you are new to the concept of liquidity and liquidity health, the Liquidity Health Dashboard is a great place to start, because it provides at-a-glance, digestible information about whether a particular project is maintaining the quantity and quality of liquidity that it needs for its token in order to survive in the intermediate and long term. It is important to understand that the Liquidity Health Dashboard is not designed to tell you what tokens to buy. As always, ApeBond does not and will never provide financial advice! Instead, It gives users and projects a way to evaluate long term project and token health, and is most useful when combined with other independent research about a project.

With that said, scores from the Liquidity Health Dashboard can help guide your research in the right direction - think of them as risk ratings, where a lower score means the token is likely more risky to hold, and a higher score means the project is likely more stable and sustainable.

With the Liquidity Health Dashboard, users are now able to access and act on liquidity information about crypto projects that have been hiding in plain sight on the blockchain. The LHD will allow users to more fully understand whether their favorite project has been making liquidity decisions for their token that align with the best long-term interests of the project’s users and token holders as well as the tokenomics data they share on their site or documentation.

There are two main views to interact with when using the LHD: the List View, and the Project View.

The List View shows 50 projects per page, with a summary of the following information:

Market Cap: The current market capitalization of the token.

24h Change: The percentage change in the market capitalization of the token over the last 24 hours.

Extractable: The for the token - the sum of the hard assets liquidity in all of the valid liquidity pairs for the token.

Strength: The ratio of the available liquidity of a token to its current market capitalization.

Ownership: The ratio between the amount of token liquidity that a project owns to the amount of liquidity that the project should own.

Concentration: A metric that illustrates how well a project establishes deep liquidity in the pools it makes available for the token.

Project View

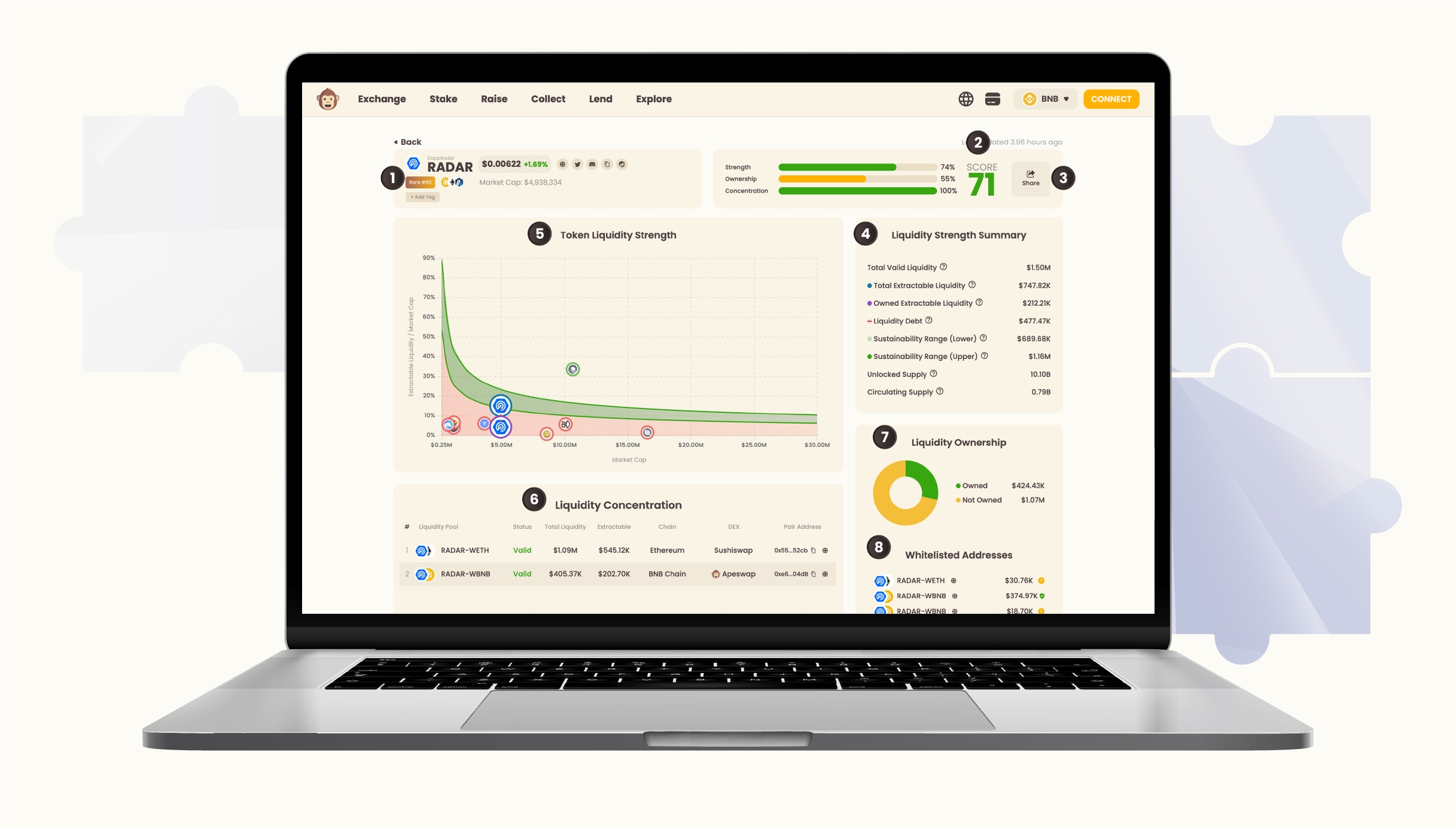

When you click on a specific project in the List View, you'll see a detailed breakdown for that project's liquidity in the Project View. Within the Project View, you can see the following information:

Token Info (1): Includes token price, price change over the last 24 hours, chains, market cap, and social links for the project.

Liquidity Health Score (2): Shows the project’s liquidity subscores for each category as well as the overall score, along with a Share feature (3) that allows users to share live LHD data about this project to Twitter.

Liquidity Strength Summary (4): Provides detailed liquidity information for the selected project’s token.

Token Liquidity Strength (5): Shows the token’s relative liquidity strength in terms of the Extractable Liquidity to Market Cap ratio. Users can zoom for more refined info and can hover over token logos for additional details.

Liquidity Concentration (6): Shows a list of the status of all liquidity pools/chains, the extractable liquidity held within those pools, and the block explorer links to each pool.

Liquidity Ownership (7): Shows the relative share of owned vs. non-owned liquidity for the project, along with a list of whitelisted addresses (8) for protocol-owned liquidity.

Liquidity Strength (LS) measures the ratio between the available liquidity of a token compared to its market capitalization. This is calculated by dividing a project’s total valid extractable liquidity (the sum of the hard assets in all valid liquidity pairs across all pools) by the project’s market capitalization (the circulating supply of the token multiplied by the spot price of the token). This metric is designed to look at if a project is maintaining enough liquidity compared to how large the market for the project’s token is. In other words: is there enough capital backing the token you are holding, or are you holding an empty bag that you cannot actually liquidate because the token is illiquid?

Simply put, LS looks to answer the following question: Does this project have enough liquidity based on its MCAP?

for

for

where:

Boundaries for plots ("sus" region):

Constants configs.:

For MCaps <= $250M:

For MCaps > $250M:

Variables description:

: Market cap. in usd

: Extractable liquidity to market cap. ratio

We look at the relationship between (from rented + owned) and the upper bound.

Anything below the range entirely is considered unsustainable liquidity. Those projects score between 0 and 70. If you are on the lower bound of the sustainability range you would have a score of 70. As you move higher into the range, you can reach a score of 100. Anything above the range is also defined as 100 for now.

In a later version of the LHD credentialing system we will start to look at what is ‘too much’ liquidity that it is capital inefficient. But for now we are focusing on what's the minimum amount of liquidity a project needs as most of the industry is undercapitalized from a liquidity perspective.

ApeBond’s highest priority is to ensure the safety of the funds of our users, of our partner projects, and of our community as a whole. The core platform and all subsequent features have been built with security at the forefront of all of our efforts.

Paladin is a trusted security partner with industry-leading audit quality, and ApeBond is proud to have its code audited by Paladin on a regular basis.

Additional audits include:

Halborn: For our Real Yield smart contracts. Audit

Sherlock: For our Solana Bonds smart contracts. Audit

We use Safe wallets to manage our contracts and treasury. These multi-sig wallets require confirmations from multiple parties.

0xAbD7853b79e488bC1BD9e238A870167B074eb714

ApeBond Treasury [ETH GSafe]

1

0x95989D97e42bd083dBe4c889c2A88Ff3b3ed70D3

ApeBond General Admin [ETH GSafe]

56

0x90274f67F02f555031f3Eb99b47213CE0A06D5B1

ApeBond Treasury [BSC GSafe]

56

0xAE42250B2b12BC6831Be33196367E71D966945D7

dev MasterApe [BSC GSafe]

56

0x50Cf6cdE8f63316b2BD6AACd0F5581aEf5dD235D

ApeBond General Admin [BSC GSafe]

56

0xA75125CF0A7be136D6745B39DB1FeBadE269ba4D

ApeBond General Proxy Admin [BSC GSafe]

56

0x7b26A27af246b4E482f37eF24e9a3f83c3FC7f1C

ApeBond Secure Admin [BSC GSafe]

56

0xb5FF1896Fbc20CA130cE4736878aac01CA852b29

Timelock Executor [BSC GSafe]

56

0x944694417A6cA0a70963D644A11d42C10e3af042

ApeBond Bonds Treasury (POL) [BSC GSafe]

56

0xE1372702a496437c61c5AC72716449ae122f07cB

ApeBond<>Ola Lending Super Admin [BSC GSafe]

56

0xb866E12b414d9f975034C4BA51498E6E64559a4c

Stader<>ApeBond BNBx Multisig [BSC GSafe]

56

0x71C0C1001520e1568e17836Cc8a19d0dbdB2BD5f

ApeBond Treasury [Polygon GSafe]

137

0x2C5fD64A3e27826CAf1A3d0F1bE6f8ED9f8a4f8A

ApeBond General Admin [Polygon GSafe]

137

0x76E010758D2AE3B81973e2047cE70168CcaE2AbF

ApeBond General for Bond Funds Transferring (for Partners - except Linea Chain)

Please review the glossary of terms and tags used in the Liquidity Health Dashboard below.

Hard Assets: The tokens one would consider as the exit liquidity for all other tokens, generally "blue chip", high market cap tokens and stablecoins

Hard asset list as of 7/5/2023: USDC, USDT, BUSD, DAI, FRAX, WBTC, ETH, BNB, MATIC, WCRO, FTM, SOL, AVAX

Valid Pair: Any altcoin that is paired with a hard asset

Non-Valid Pair: All altcoin-altcoin pairs (any token paired with a non-hard asset)

Total Liquidity: The sum of ALL liquidity pools the token has (includes liquidity classified as ‘not valid’)

Total Valid Liquidity: The sum of only the valid liquidity pools

Total Extractable Liquidity: The sum of the hard assets liquidity in all of the valid pairs

Circulating Supply (CS): Tokens that are in circulation, pulled from CoinGecko

Market Capitalization (MCAP): The circulating supply multiplied by the spot price of the token, pulled from CoinGecko

Extractable Liquidity / MCAP ratio (EL/MCAP): Provides a ratio on the current extractable liquidity compared to the project's MCAP, used as a benchmark how much extractable liquidity a project should have based on its MCAP, expressed as a percentage

Sustainability Range: The acceptable range of Extractable Liquidity any project should have based on our methodology here.

Sustainability Range Upper Bound: The top of the sustainability range

Sustainability Range Lower Bound: The bottom of the sustainability range

Owned Liquidity: Liquidity that is held and owned by a protocol in a known protocol address, or ideally locked behind a vesting contract / in a gnosis safe, also known as protocol-owned liquidity (POL)

Owned Liquidity has 2 types:

Known Liquidity - Ownership addresses the ApeBond has manually verified and curated (or a 3rd party has submitted a PR)

Suspected Liquidity - Ownership addresses that ApeBond found through automated mechanics (such as searching block explorers and confirming the address is a multisig or locking contract) by checking the bytecode of the contract.

Rented Liquidity: Liquidity that is crowdsourced through yield farming or liquidity mining

Unlocked Supply: Tokens that are unlocked on-chain

DEX

Protocols where you can swap/trade cryptocurrency

Bond

Protocols that offer bonding (purely DeFi, anything to do with 'Real World Assets' goes in the RWA class

Lending

Protocols that allow users to borrow and lend assets / mint stable coins

Bridging

Protocols that bridge tokens from one network to another

Liquid Staking

Protocols that allow you to stake assets in exchange of a reward, plus the receipt for the staking position is tradable and liquid

Yield

Protocols that pay you a reward for your staking/LP on their platform

Stablecoin

Protocols that provide algorithmic stable coins OR stablecoins

Yield Aggregator

Protocols that aggregated yield from diverse protocols (largely vaults / dashboard)

Derivatives

Protocols for betting with leverage / options

Synthetics

Protocol that created a tokenized derivative that mimics the value of another asset.

Insurance/Security

Protocols that are designed to provide monetary protections / risk mitigation

Launchpad

Protocols that launch new projects and coins

NFT Launchpad

Protocols that launch NFTs

Real World Assets

Protocols that deal with any non-native crypto assets in any capacity (Tradfi fixed income, tokenized real estate, etc)

Metaverse

Projects that are building a metaverse experience

GameFi

Projects that have a clear 'playing' mechanic

X-2-Earn

Anything that is [blank] to earn (besides GameFi)

Wallet

Protocols that offer the ability to pay/send/receive cryptocurrency

Index

Protocols that have a way to track/created the performance of a group of related assets

NFT Marketplace

Protocols where users can buy/sell/rent NFTs

NFT's

Projects that are working with NFTs that dont fit other launchpads

Oracle

Protocols that connect data from the outside world (off-chain) with the blockchain world (on-chain)

Blockchain

Other L1's or L2's

Marketing Solution

Protocols that help with marketing

Social Media

Protocols that are moving Web2 social into Web3 in some capacity

Gambling

Protocols that facilitate any type of gambling

Memecoin

All the dog coins and their offshoots

AI

Projects that are leveraging AI, automation, etc

Infrastructure

Projects related to blockchain infrastructure and ease of building Dapps

CEX

A platform where users can trade cryptocurrencies through a central intermediary that facilitates and oversees all transactions.

Other

A place to park everything else

ApeBond Core Team Organization

RandomApe - Head of Product/Backend Engineer Fede - Frontend Dev Doublo - Solidity Dev Casor - FullStack Dev IM$ - UI/UX Designer Efe - Operations Lead Shivam - Support & Testing Specialist

Adam - Head of Biz Dev Boba - Biz Dev

Aldunnie - Head of Communications Banana Guy - Social Media Manager WesKing - Community Manager & BD Associate

Lisa - Financial Controller Obie Dobo - Advisor & Co-Founder Apetastic - Advisor & Co-Founder ApeGuru - Advisor & Co-Founder Doublo - Solidity Dev LawApe - Legal Advisor

Transparency and trust are at the core of ApeBond.

This page provides full visibility into our key wallets, including the Dev Master Ape, ApeBond General Admin, Expense Wallet, ApeBond Treasury, and others essential to the operation and development of our ecosystem.

These are all ApeBond MultiSig wallets. Please refer to them when transferring tokens for Bond deals.

Dev Master Ape

BNB Chain

ApeBond General Admin

BNB Chain

ApeBond Secure Admin

BNB Chain

Timelock Executor

BNB Chain

ApeBond Treasury

BNB Chain

ApeBond Bonds POL

BNB Chain

ApeSwap Lending Network Fees (for Treasury)

BNB Chain

ApeBond General Proxy Admin

BNB Chain

Original Admin Wallet

BNB Chain

DEX LP Fee Collector

BNB Chain

Partner Token Wallet

BNB Chain

Expense Wallet

BNB Chain

Contributor Incentives Wallet

BNB Chain

Vault Fees

BNB Chain

LiFi Claim Wallet

BNB Chain

ApeSwap Pro Revenue

BNB Chain

Bonds back end fee collector

BNB Chain

ApeBond General Admin

Polygon

ApeBond Treasury

Polygon

DEX LP Fee Collector

Polygon

Extra Polygon Gnosis Safe

Polygon

Partner Token Wallet

Polygon

ApeBond Treasury

Ethereum

Partner Token Wallet

Ethereum

DEX LP fee collector

Arbitrum

ApeBond Treasury

Arbitrum

Ethereum

0x76E010758D2AE3B81973e2047cE70168CcaE2AbF

Linea

0x76E010758D2AE3B81973e2047cE70168CcaE2AbF

BNB

0x76E010758D2AE3B81973e2047cE70168CcaE2AbF

Polygon

0x76E010758D2AE3B81973e2047cE70168CcaE2AbF

Arbitrum

0x76E010758D2AE3B81973e2047cE70168CcaE2AbF

Base

0x76E010758D2AE3B81973e2047cE70168CcaE2AbF

AVAX

0x76E010758D2AE3B81973e2047cE70168CcaE2AbF

Sonic

0x76E010758D2AE3B81973e2047cE70168CcaE2AbF

Berachain

0x76E010758D2AE3B81973e2047cE70168CcaE2AbF

IOTA

0x907cEc57456ADb5484921771d692a74c2Dd0d107

GraphLinq

0x907cEc57456ADb5484921771d692a74c2Dd0d107

CrossFi

0x6261BF2D8E3eDBFAEF0e4eD41113E7De1F15D89e

Solana

64fN8E7pBPpHAY2W1xBkqmTkCqZiSTgrSZCgMD5P8uNJ